Supporting America’s Student Parents

One-fifth of college students are parents. That’s more than three million undergraduates balancing classes, homework, jobs, and caregiving to build better futures. But higher education wasn’t designed for them, and it shows: student parents are far less likely to complete their degrees than peers without children. Parents pursuing postsecondary education and training face multiple challenges.…

Read MoreEquity Now Policy Toolkit

Today’s students of color face systemic inequities that are woven on campuses, in state halls, and in federal policies, and that are unfairly holding them back from achieving their goals. Despite the dedication and talent today’s students bring to classrooms across the nation, many are not succeeding due to outdated and inequitable federal policies, allowing…

Read MoreCollege Emergency Aid

Today’s students pursuing higher education face many financial challenges in addition to rising college costs. Federal need-based financial aid programs were never designed to cover coinciding education costs, let alone unexpected financial setbacks that arise during the course of a program, like car repairs or employer layoffs. Emergency aid is a critical and proven tool…

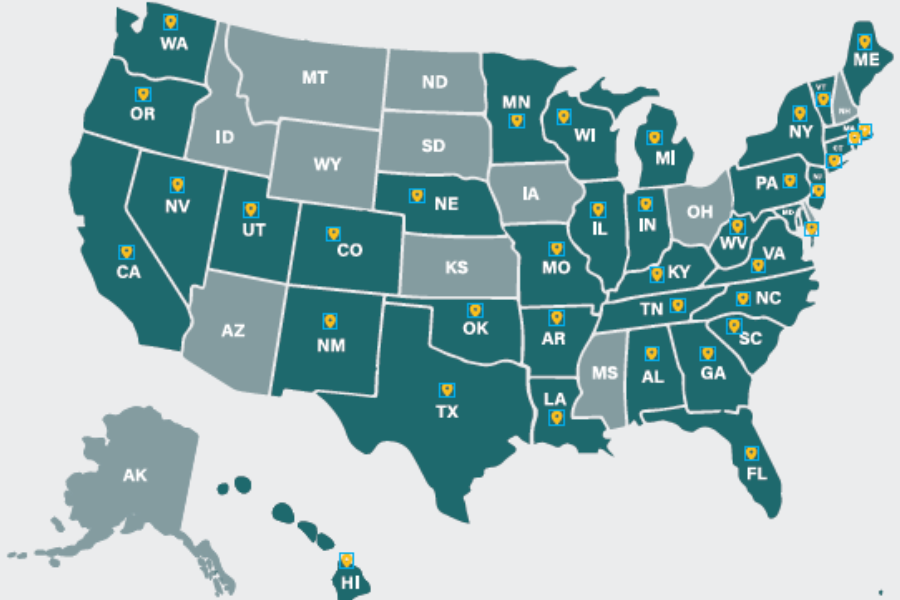

Read MorePutting the Basic Needs of Today’s Students on the Map

In this landscape analysis, we reviewed policies and strategies throughout the U.S. designed to help meet the basic needs of today’s students, an increasing area of focus for colleges and universities and for policymakers. Time and time again, research has shown that student retention, persistence, and completion are strongly influenced by whether students face basic…

Read MoreToday’s Students Deserve Their Fair (Data) Share

Postsecondary credentials are a good investment for individuals, families, and communities. Yet college tuition and fees have increased at a much faster rate than financial aid. As college costs continue to rise, along with food and housing prices caused by inflation, students still need to meet the most basic necessities of living. But meeting basic…

Read MoreThe Numbers Speak for Themselves: Using FAFSA Data to Secure Today’s Students’ Basic Needs

Numbers Speak Basic needs insecurity adversely affects students’ well-being, as well as their college persistence and completion. Research shows that food and housing insecurity are contributing factors to lower graduation rates. Higher education funding alone is not enough to meet those needs. One solution is to ensure students access all available financial support, including means…

Read MoreBack to Basics: Solving Today’s Students’ Food, Housing, and Basic Needs Insecurities

A recent study found that three in five college students experienced insecurity in meeting their basic needs, such as housing and food. However, many federal safety net policies designed to support Americans in need were not created with today’s postsecondary students in mind. Research now shows today’s students struggle to meet their basic needs…

Read More101: Single Moms in Higher Education

We met Kimberly Salazar, a single mother of a 5-year-old, last year during Higher Learning Advocates’ National Student Parent Month Fireside Chat. A first-generation student at University of California, Berkeley, and 4.0 GPA sociology major, Salazar was accepted into her school’s honors program for seniors. She also represents one of the nine in…

Read MoreUpdated 101: Today’s Students

Today’s Students 101 Higher Learning Advocates’ Today’s Students 101 contextualizes who today’s students are and why their needs matter to help inform essential higher education policy conversations. Understanding who today’s students are is fundamental to creating a higher learning system that leads to their success. HLA’s Updated Today’s Students 101 features: The newest data…

Read MoreHigher Education Policy Toolkit

Education creates opportunities and is integral to maintaining America’s globally competitive economy. An educated workforce begins in local communities and expands to the state, the nation, and the world. Higher Learning Advocates higher education policy toolkit for the 118th Congress focuses on connecting opportunity, supporting students, and delivering value with solutions to help strengthen our nation’s…

Read More